On the 19th of May, the Addis Tax Initiative (ATI), the Development Partners Network on Decentralisation & Local Governance (DeLoG) and the Norwegian Agency for Development Cooperation (Norad) jointly organized a new webinar in a series on the role of subnational domestic revenue mobilisation (DRM) for public service delivery: Opportunities and Challenges of Property Tax Reforms for Localising the Sustainable Development Goals.

Property taxes are key to unlock the revenue-raising potential of local governments. The aim of the webinar was to enable participants to dive deeper into and have a frank discussion about the opportunities and challenges brought by property tax reforms, and how they can help improve the fiscal space of local governments while combating inequalities. Wilson Prichard (ICTD) opened the discussion by introducing the central question of the day: What role can property taxes play as a means to raise revenues to reduce inequality and finance public service delivery?

Decentralization promises government closer, and more accountable, to citizens. The success, however, depends on having own source revenues, and collecting taxes in ways that engage citizens. Property taxes provide the backbone of subnational revenues, which shows the extreme important of efficient en effective management, says Prichard. However, it turns out that across the globe, local governments are dealing with significant policy weaknesses, ineffective data management and administration and incomplete and inaccurate property rolls. Prichard distinguished technical barriers from political ones, as both need to be addressed differently. As of the latter, one can think of resistance by taxpayers, administrations or central governments (e.g. resistance to local governments gaining greater fiscal autonomy). Therefore, Prichard stresses the need for strategies to bring central governments on board. Post-COVID governments are looking for new revenue sources focused on those more able to pay and this creates a window of opportunity. At the same time, there is a growing understanding of needs and one can take example from recent success piloting reform strategies. This shows the potential and opportunities in the field of property tax reforms.

Three different perspectives

After a first moment of discussion about the role property taxes can play in reducing inequality, three experts were given the floor to talk about their experience on the topic. Rosetta Wilson (Financial Management Advisor, Freetown) shared her thoughts on the question What can fellow local governments learn from Sierra Leone’s capital for catalysing property taxation for local revenue generation? Wilson tells how Freetown approached the revenue mobilization. They geo-mapped the city and referencing of properties using PlusCodes. A new valuation system was introduced, using a points-based approach taking into account size, type and quality based on property features instead of purely area-based method. Among the outcomes: five-fold increase in revenue potential; assessment of property values in a more equitable transparent and progressive ways; and increased revenue collection for the city! Wilson emphasizes their important lessons learned: bring on board all stakeholders and commitment to managing change. And, as she rounds up: be patient and be ready for the long haul!

Samuel Sserunkuuma (Director Revenue Collection, Kampala) elaborated on how Uganda’s capital uses property taxation for local revenue generation. Sserunkuuma also shared the challenges they faced during the process: ambiguous exemption regime, inability to pay on account of low occupancy, poverty, as properties are the only source of income for low income earners; and resistance of political players. He stressed the importance of explaining to local authorities ánd citizens how property taxation ultimately could and should lead to better service delivery. As regards the Kampala case study, Sserunkuuma describes three ways forward: enhancing the regulatory framework, enhancing collaboration with local politicians in revenue mobilization and linking services to tax efforts.

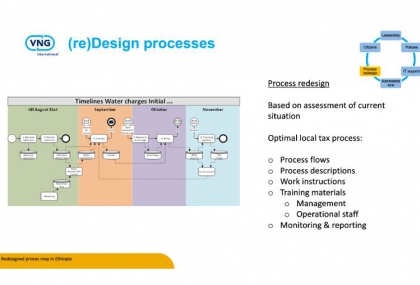

Siebe Stellingwerf (Project Manager, VNG International) was asked to explain VNG’s approach to improving property taxes. Being a specialist in the field of Taxation at a company that excels in strengthening democratic local governments, Stellingwerf elaborated on their Local Tax Hub with specific projects on subnation DRM, for example in Ghana, Ethiopia and they support the local governments in the Palestinian Territories.

Central to VNG’s integrated approach stands the conviction that local partners are in the lead. VNG International created the knowledge hub, which is designed to combine social components with technical components. Social components, as explained by Stellingwerf, are leadership, citizens and policies. IT support and administrations are among the technical components. He states: “To increase tax collection, tax compliance is key. And to increase tax compliance, citizens need to trust their government. Increase transparency and the willingness to pay will increase too.”

It is not always an instant success story, admits Stellingwerf. He touches upon three main challenges: technical challenges (e.g. working with existing data versus new data collection methods) and political challenges. Commitment at central level is important, as they need to promote local DRM and fiscal autonomy. At the same time commitment at the local level is key: LAs have to be willing to increase accountability and transparency. And what if political commitment is lacking? “There needs to be an expression of commitment to the project. If the commitment is too low, the supervisory committee could and should intervene. However, experience shows that if there is a new interaction between LAs and citizens on the topic of taxation, people get a very strong sense of what they have to pay and what they are getting back for it. This underlines the extreme importance of citizen participation in the process,” according to Stellingwerf.

This session builds on a first webinar that took place in April 2021 to raise awareness for the potential of subnational DRM for improving development finance, supporting state-building efforts and strengthening local governance in partner countries. It contributes to the overall goal of bringing the local governance and tax communities closer together to enhance equitable and efficient DRM at the subnational level.